Automotive Interiors Expo North America returned to Novi in October this year as a focused industry meet-up where materials science, human-centered design and systems integration products and services were exhibited to OEMs, Tier 1 suppliers and the wider automotive interiors community.

In addition, at the free-to-attend Innovation Showcase and InteriVision Summit conference streams, leading voices and companies presented case studies and trends for the future of automotive interiors to an audience looking for practical ways to make cabins lighter, quieter, more sustainable and emotionally compelling. The programs blended tactical product demos with strategy-level thinking, making the event especially useful for senior decision-makers weighing near-term sourcing and longer-term architecture choices.

What stood out

- Materials and sustainability as standard practice – Recyclable blends, wood-flour thermoplastics and engineered nylons showed that suppliers have moved beyond eco PR into manufacturable alternatives that meet cost and cycle-time constraints. Saco AEI Polymers’ XR Sheet and Toyobo’s Glamide grades were examples of materials on show that aim to replace heavier or less-recyclable substrates without compromising structural or finish performance.

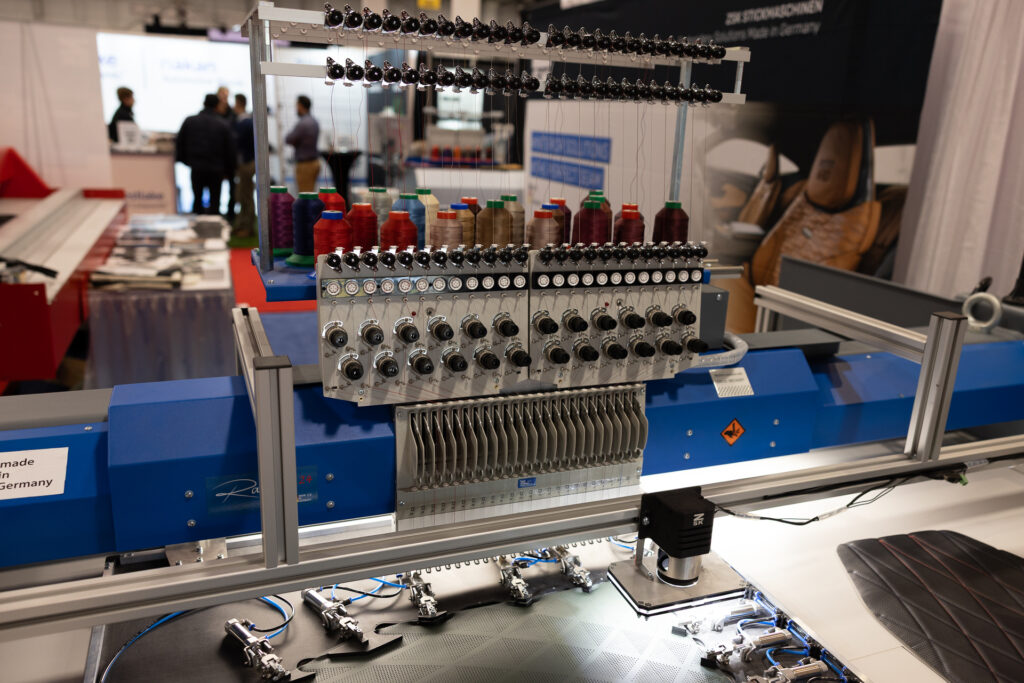

- Speed, agility and design flexibility – Rapid prototyping and expedited sample timelines were recurring talking points. Synergeering Group’s RapidNylon was used to deliver a full show vehicle interior. The material can reduce production timelines through additive manufacturing, and the company explained to expo visitors how fast turnaround can directly de-risk program schedules. For OEMs and Tier 1s facing compressed launch calendars, that capability is increasingly decisive.

- Integrated electronics, haptics and NVH – The cabin is now a system: haptics, ambient lighting and tactile finishes are being designed-in, alongside actuators, sensors and software. Klüber Lubrication’s Automotive Noise Kit and Origin’s compact torque limiters demonstrated that engineers are addressing squeak, rattle and precision motion as part of the complete user experience.

- Measurement, validation and supply-chain control – Color, texture and finish remain critical. Tools such as Advanced Color Technologies’ DeltaEZ make in-line or on-site validation faster and more actionable, which matters when global suppliers must prove consistency across suppliers and build sites.

These themes were reinforced across the Innovation Showcase and InteriVision Summit, which combined tactical case studies with forecasting and design strategy – a useful pairing for those leading technical sourcing and interior design. These forums have matured into must-attend presentations for industry-leading voices to exchange strategic directions with the automotive interior community.

Exhibitor highlights

- Hansi – Advanced adhesive systems spanning reactive PU hot-melts, thermoplastic polyolefin solutions and low-VOC water-based PU adhesives. Practical capabilities for wrapping PP/NFPP and bonding mixed substrates – a simple set of fixes with big implications for in-car fit and finish.

- Origin – Compact torque limiters that combine brake and clutch functions for electric actuators (two-stage power backdoor limiter among them). The designs promise quieter, more reliable motion in miniaturized actuator systems.

- Saco AEI Polymers – XR Sheet (a polypropylene + wood-flour blend) for door panels, parcel shelves and liners – recyclable and supported by a buy-back program that addresses circularity at part level.

- Toyobo – High-strength engineering resins (PBT, nylon, Glamide JF-30G) that are replacing metal in structural interior parts, helping to achieve lightweighting targets with grade-A finishes. Read more details on these Day 1 highlights here.

- Advanced Color Technologies – DeltaEZ mobile spectrophotometer and software suite for rapid, reliable color validation across materials – a practical response to cross-supplier color failure points.

- Synergeering Group – RapidNylon full-interior parts and quick-turn production that have rescued vehicle programs by delivering samples and production parts in days/weeks rather than months. A strong value proposition where tooling or supplier delays are program critical.

- Klüber Lubrication – Automotive Noise Kit: 21 specialty lubricants and demo tools for NVH, seat kinematics and switch haptics, targeted at solving squeak/rattle and improving long-term durability. Read more details on these Day 2 highlights here.

Conference takeaways

The InteriVision Summit presented several strategic threads that are important for procurement and product strategy teams:

- Data-driven forecasting (Tanya Chantiri, S&P Global Mobility) reinforced that interior features will continue to shift with consumer expectations for comfort, personalization and software-led experiences, meaning materials must be chosen with lifecycle and updateability in mind.

- Design for emotion + systems integration (Jesse Diephuis, General Motors) emphasized that micro-interactions – haptics, sound strategy and subtle motion – create disproportionate brand value. That elevates suppliers who can work across hardware, materials and software.

- Post-EV control strategies and functional safety panelists (Lori Mavis, Derek Prentice and Tony Sumcad) explored how EV architectures are enabling new layout possibilities but raising questions about redundancy, safety and human-machine interaction design. This was actionable intelligence for Tier 1s shaping next-gen cockpit ECUs and for OEMs planning product roadmaps.

The Innovation Showcase highlighted overarching themes driving industry evolution:

- AI and automation are streamlining inspection and quality assurance, reducing human error and accelerating production timelines.

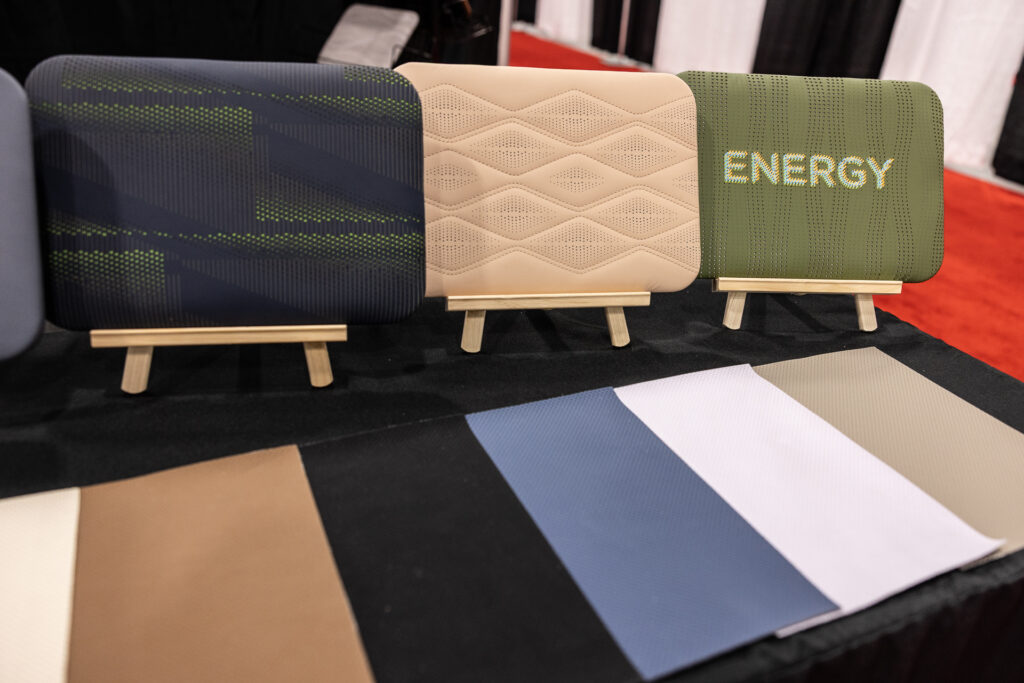

- Material innovation emphasizes sustainability without compromising performance, from lightweight polymers to recyclable composites.

- Design efficiency and functionality are converging, with advanced 3D structures, nonwovens and multifunctional surfaces redefining interiors for future mobility.

This thematic approach reflected an industry focused on integrated innovation, where technology, sustainability and user experience are inseparable.

What this means for suppliers and OEMs

- Buy materials that simplify recycling workflows. Recyclable thermoplastic blends and buy-back programs are moving from pilot to production-level confidence. Suppliers that can provide closed-loop systems will have an edge.

- Invest in rapid validation tools and services. Color and surface consistency remain costly failure modes; on-site spectrophotometry and rapid prototyping services will reduce late-stage changes.

- Offer system solutions, not components. OEMs increasingly want suppliers that can manage motion, haptics and NVH as integrated subsystems, particularly where electronics and materials intersect.

To conclude

Automotive Interiors Expo North America 2025 illustrated that the sector is not only innovating but also strategically aligning itself with the future of mobility. From sustainable substrates and adhesives to AI-assisted design and functional safety, exhibitors and thought leaders collectively signaled that the in-cabin experience will continue to evolve rapidly.

For OEMs and suppliers, the message is clear: success in automotive interiors now requires a balance of aesthetics, advanced materials, intelligent systems and sustainable practices. Events like this remain critical for connecting industry stakeholders, sharing knowledge, and shaping the next generation of vehicle interiors.

Dates for your diary

Next year the show returns in a new format as part of Vehicle Tech Week North America. We look forward to welcoming our exhibitors and visitors to this new festival on October 27-29, 2026, encompassing Automotive Testing Expo, Autonomous Vehicle Tech Expo and Automotive Interiors Expo. Save the dates on your calendar and read more about Automotive Interiors Expo North America 2026 here